The securities market is an important segment of the economy that stimulates the development of a country. It allows you to judge the welfare of the state, make a decision about investing business and make a forecast of its profitability. The world’s largest stock exchanges are represented in developed countries, and a prominent representative of such a trading platform is.

The world’s largest stock exchanges: the financial market of New York

The New York Stock Exchange is located in New York. It is considered the largest stock exchange, where 60% of the total number of transactions in the world market are carried out. For more than 100 years this platform operates with securities. Throughout its history, the phenomenal rises of small companies have been observed here, and the large corporations have suffered a fiasco. The leadership of the NYSE determines whose economy will develop in the near future, and who will become an outsider, despite past achievements.

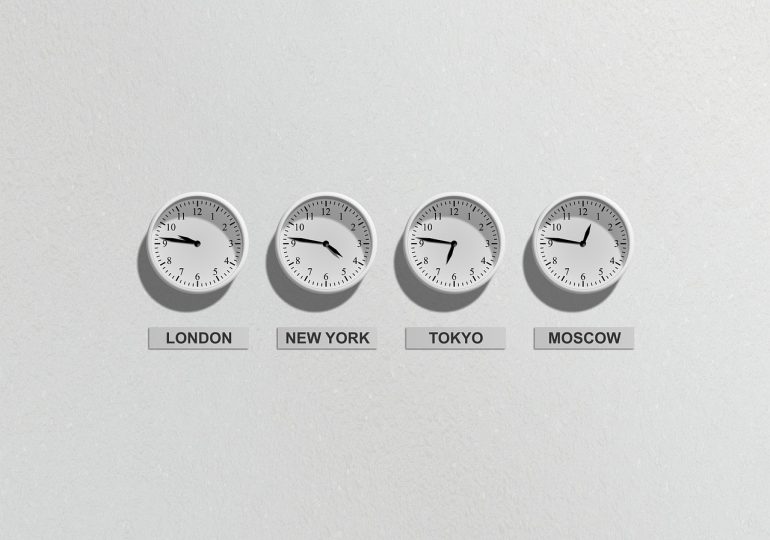

Every self-respecting trader must keep track of the slightest fluctuations on the stock exchange in order to succeed in the profession. Decisions made in this financial center of the world, already in 10-12 hours, affect the quotations of the countries of Europe and Asia. Most merchants in the market take the NYSE as the basis for their operations and approach.

The largest world exchange was founded in 1868. At the moment, its capital is 28 trillion. dollars. Trade participants registered more than 4 thousand, 50% of which belong to US assets.

The exchange works 5 days a week, from 9:30 to 16:00 (Eastern time). At the beginning of the day trading is carried out, and at the end – closing.

Thanks to the century of information technology, all financial transactions occur automatically. An exception is activities with stocks that are high priced or rarely enter the market.

If earlier foreign bidders were clearly tied to the hours of the exchange, now everything happens in the shortest possible time and is organized in the form of a continuous auction.

To become a member of the NYSE stock market, you must contact a brokerage company for the service. The latter should have appropriate certification permitting activities on the site. After completion of all organizational issues, the investor must install special software through which access is provided to the exchange. The participant can conduct the auction independently or through a broker.

If before the activity on the world’s largest stock market was active and resembled a lively bazaar, then thanks to online operations, everything can be controlled through the electronic system, making a minimum of effort to participate. But despite the automation of the process, the broker shoulders a great responsibility for the large flows of money that pass through it in a short time.