Head of US FRS against the President: who should prevail?

Donald Trump took up the old. Consistent criticism by President Fed President Jerome Powell may lead to the resignation of the latter. It is reported that the guarantor is dissatisfied with raising the base rate, as it deprives the country’s economy of competitive advantages and reduces the capitalization of America’s largest corporations. At the same time, Mr. Powell is a specialist appointed by Trump continued the course of his predecessor, Jannet Yellen, to tighten monetary policy.

Why does the President criticize the head of the US FRS and what can this affect

In 2018, Donald Trump at least four times held tough conversations with the head of the US FRS. Criticism reached the peak in the last months of last year, when monetary conditions returned to those of 2008 (2.25–2.50% per annum). In December, there were reports that the US President plans to dismiss Jerome Powell. The unconfirmed information, however, slightly shook the market, although everyone understood that to eliminate legally the head of the US Federal Reserve in a short time is almost impossible. Over time, Trump’s words have been refuted.

Such a public censure of one of the chief officials can play a trick with the President of the State. At a minimum, it is fraught with the creation of a negative opinion about the department’s policy among society, which ultimately leads to a decrease in confidence in it from international investors.

Why will Trump fail to remove from office the head of the US FRS?

No matter how hard the US President tries to influence the work of the body, he must be independent. Also, history shows that, from the point of view of the guarantor, the unpopular Fed actions ultimately saved the country from the crisis.

For example, in the middle of the 20th century, the leaders of the country repeatedly criticized the FRS. However, the increase in base rates that has now been outlined were carried out then, which helped keep inflation in the United States and did not allow the States to slide into the financial hole after the wars in Korea and Vietnam.

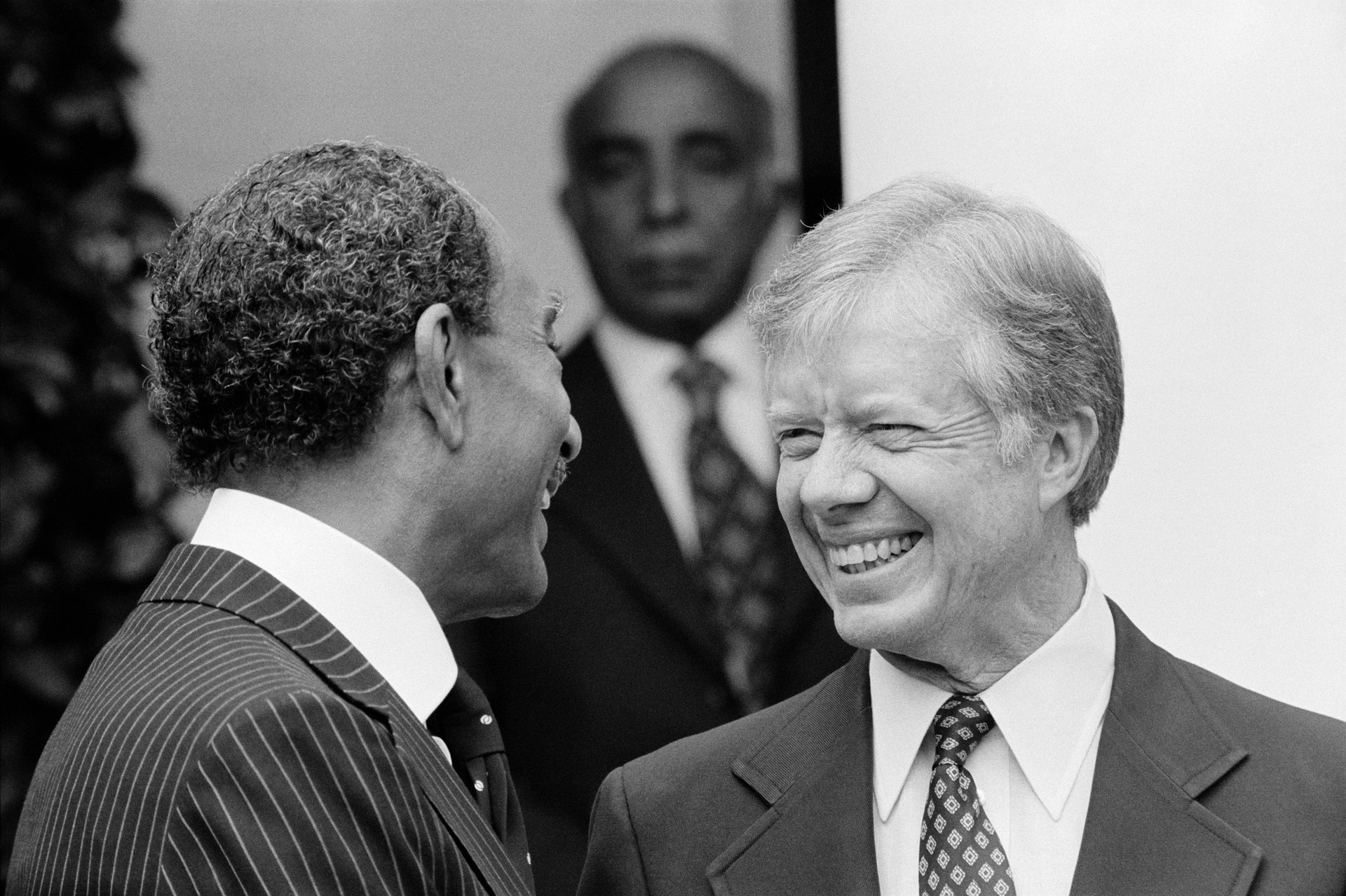

Another vivid example of the correct actions of FRS leaders happened in 1979. Paul Volker, who was appointed to this position, also resolutely began to raise the rate and met with no less serious resistance from the then President Jimmy Carter. However, due to the work of Volcker, inflation in America for 8 years has decreased almost four times – from 11.22% to 3.66%, the economy has gone out of the crisis, and unemployment has decreased by times. Also, thanks to the policy of the head of the US FRS since the late 1980s, the central banks of the world have gained more freedom in the formation of monetary policy. These changes can be considered evolutionary, since they led to the development of important geopolitical processes and political impartiality in making strategic decisions by national financial regulators.

It is obvious that the actions of the heads of world central banks have a tangible impact on world capital. The independence of such bodies creates the necessary degree of objectivity for the vector of investment flows and allows to avoid the not always justified pressure from the Presidents of the countries.