Global investments of 2019: all attention is on the USA

According to analysts, the year 2019 will inherit the main trends emerging in 2018. Namely, an increase in the profitability of United States government bonds. Moreover – the growth rate of the national currency.

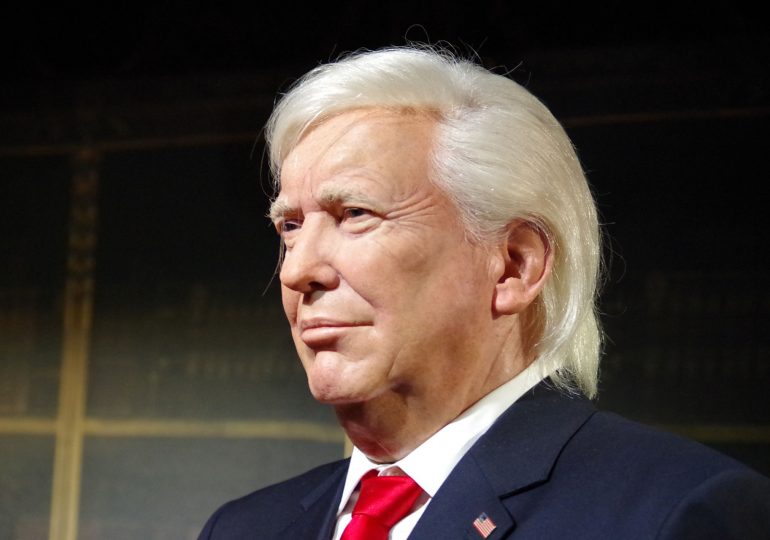

During the election campaign, President Donald Trump promised to give a second wind to American industry, as well as reduce risks from overseas competition. Since the 1970s, the net international investment position has been deteriorating in America. According to the results of 2018, the indicator was in a noticeable minus and exceeded 40 percent of GDP. Trump is trying to fix the existing situation.

The policy of reducing the trade deficit by the United States seems controversial. In protecting the domestic market, the Trump administration applies new restrictions.

The result is obvious: the partners impose their sanctions – already against the United States. That is not the best way reflected in the volume of exports. The recent tax reform has been hindering the reduction of the trade and current account deficit.

In 2019, President’s actions to reduce trade deficits will be observed. So, the financial markets will surprise with their instability. Much depends on Trump’s negotiations with trading partners, and on the results of the economic truce with China.

In addition, the volatility of the markets was a consequence of the growth in the yield of United States government bonds. Since this is a low-risk asset, increasing returns can lead to an outflow of stock from the market.

Successful global investments in 2019 and the prospects of emerging markets

A low net investment will cause the dollar to fall further against major currencies. It is predicted that at the beginning of 2019 DXY will decrease from 97% to 94. Moreover, by 2023, it will fall to 76%.

The weakening of one of the major world currencies, even against the background of the growth of bonds, will shake the usual market mechanisms. Previously, an increase in interest rates in $ always led to an inflow of capital into the States and, accordingly, a decrease in their capital emerging markets. Now things can change, and emerging markets will become promising for investment.

Of course, Chinese assets are the tastiest morsel for investments. In 2018, they cost less due to the policies of Donald Trump. Nevertheless, the growth of the economy in heaven in 2019, according to forecasts, will be 6.4%.

In this context, European stocks look promising. These securities have a trade discount of 7% to the global market. Moreover, 20% in relation to the US stock market. Nevertheless, corporate profits in Europe will exceed the average for the planet.

With regard to the UK, here the experts remain neutral. Brexit carries above all political risks that flow into economic.

The main factor to be borne in mind in world markets is the increase in interest rates in the United States and Europe. This will automatically reduce the value of bonds in these countries. Therefore, interest in Chinese government bonds is projected.